About Us

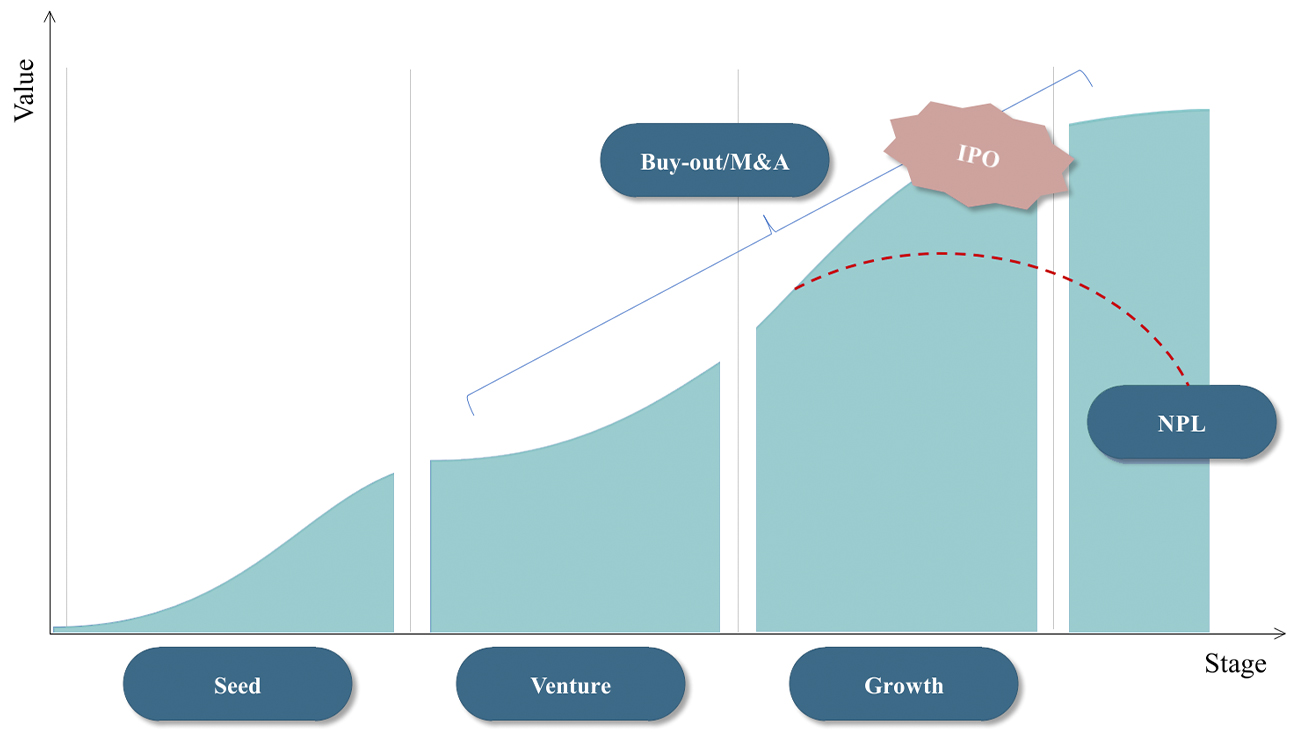

We build an investment environment for the investors as well as portfolio companies to achieve mutual growth.

-

For the past 30 years, UTC Investment has built a successful investment track-record through its high caliber asset management professionals with more than 10 years of average investment experiences.

We are focusing on building internal competency and securing additional growth opportunities through active value-up activities in such sectors as bio/healthcare, life-style and IT/semiconductor in which we are market leader.

-

We place top priority in performance and trust, and strive to grow with both investors and investees by actively developing market leading venture companies.